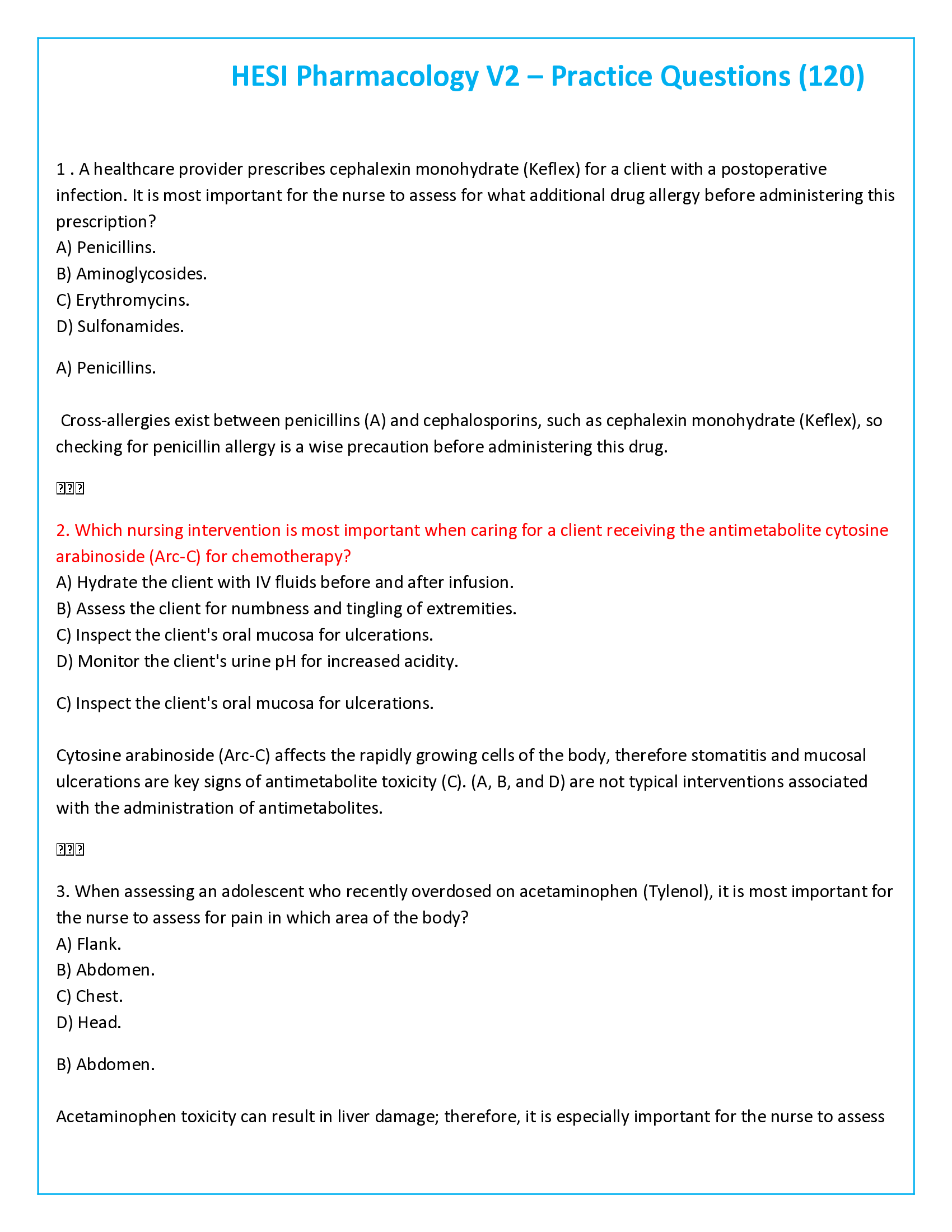

Frequently Asked Questions

What Do I Get When I Buy This Study Material?

+When you buy a study material on Passing Grades, an instant download link will be sent directly to your email, giving you access to the file anytime after payment is completed.

Is Passing Grades a Trusted Platform?

+Yes, Passing Grades is a reputable students’ marketplace with a secure payment system and reliable customer support. You can trust us to ensure a safe and seamless transaction experience.

Will I Be Stuck with a Subscription?

+No, all purchases on Passing Grades are one-time transactions. You only pay for the notes you choose to buy, with no subscriptions or hidden fees attached.

Who Am I Buying These Study Materials From?

+Passing Grades is a marketplace, which means you are purchasing the document from an individual vendor, not directly from us. We facilitate the payment and delivery process between you and the vendor.

Does Passing Grades Offer Free Study Materials?

+Yes, sellers on Passing Grades have uploaded numerous free test banks, exams, practice questions, and class notes that can be downloaded at no cost.